Owner Readiness: Challenges and Opportunities When Preparing for Exit

Read the Article

Read the ArticleKey Takeaways

- Being sell-side ready involves having a clear vision of your goals for the transaction and positioning your company optimally to achieve them.

- There is often a disconnect between understanding the importance of transition planning and actually taking action to prepare for exit.

- Approximately 50% of business owners are forced into involuntary exits.

Selling a business is a pivotal moment in any owner’s career — often a once-in-a-lifetime event. Even so, many business owners find themselves unprepared when an opportunity to sell emerges.

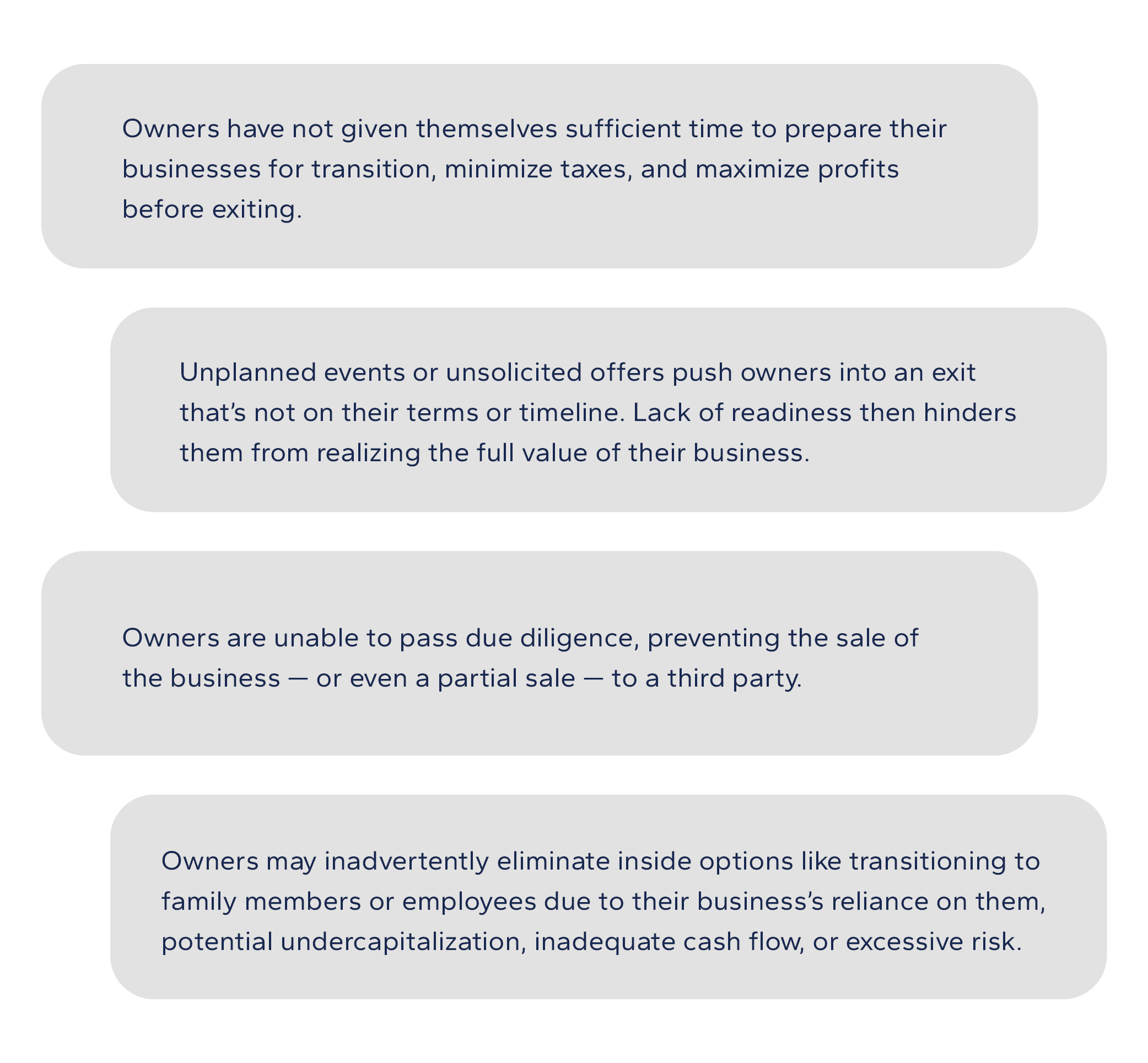

In the 2023 State of Owner Readiness Report, The Exit Planning Institute described the following as the most common problems facing business owners during their transition:

The ongoing success of a business has a ripple effect that extends to employees, vendors, customers, charitable organizations, and the community. This means that you, as the owner, must be prepared and ready for sale when the time comes.

Key Considerations in Sell-Side Readiness

In a broad sense, achieving an effective transition is reliant on the owner optimizing business value, preparing for life without income from the company, and developing a plan for themselves after stepping away from the business.

Being sell-side ready, then, encompasses:

- Financial and psychological readiness to endure the demands of the transaction.

- Realistic expectations and a deep understanding of the transaction process.

- Having the essential foundations in place to navigate due diligence.

- Ensuring your team is ready to continue operations under new ownership.

- Making necessary adjustments to enhance the value of your business.

How can I start preparing my business for an eventual sale?

The best way to prepare for transition is to put yourself in the mind of your potential buyers. Consider what is most appealing to them. Some suggestions include:

- Maintain financial records using accrual accounting on a monthly or quarterly basis.

- Negotiate payment terms and prices with vendors and customers to enhance value.

- Diversify your customer base and product portfolio.

- Stay informed about market dynamics and your industry's position within the market.

- Formalize management by creating contracts with related parties on payroll.

- Ensure transferability of contracts with vendors and customers.

- Optimize the utilization of working capital.

- Invest in capital equipment to reduce reliance on vendors.

- Adopt a capitalization policy, capitalizing assets on the balance sheet instead of expensing them.

- Perform a due diligence analysis on your business to assess your readiness.

Why is such preparation essential to the success of the transition?

Selling your business is a significant transaction. Although you may feel ready, you won’t truly understand the physical, mental, and emotional toll until you’re in the process. However, taking steps to prepare will help you navigate common pitfalls, including:

- Deal Fatigue: This is both a psychological and emotional challenge that arises when sellers underestimate the effort involved in the process. Being prepared helps you avoid this pitfall, preventing the disruption of your business and unnecessary time and financial investment.

- Analysis Paralysis: Sellers often get overwhelmed by ongoing due diligence and financial analysis. Sell-side readiness gives you the time to organize and prepare these documents, sparing you the stress of addressing these issues mid-process.

- Late-Stage Valuation Adjustments: During due diligence, buyers may uncover critical details that affect their valuation. Being prepared enables you to address these issues before they derail the deal, keeping you from being stuck in a prolonged due diligence process.

Lessons Learned in Sell-Side Readiness

Lesson 1: Now is the time to prepare for exit.

There is often a disconnect between understanding the importance of transition planning and taking action to prepare for exit. Your exit plan should be part of your overall business strategy. It should be a living, breathing component that impacts the way you run even the day-to-day operations of your business. Keeping your exit plan at the forefront allows you to strategically and thoughtfully increase the value of your business and make it appealing for future owners.

Another aspect of early exit planning is gifting considerations. For those transferring the business to family members, starting early is essential. Gifting portions of the company can have significant tax implications. Proactive planning allows for tax-efficient strategies and provides beneficiaries with a clear understanding of their future roles within the business.

Moreover, planning now provides the luxury of making strategic decisions that align with long-term objectives. Approximately 50% of business owners are forced into involuntary exits. Having time on your side allows for careful consideration and the implementation of a strategy that best fits the desired outcome.

Finally, early planning allows for greater flexibility in choosing optimal market conditions for the exit. Business owners can take advantage of favorable economic circumstances and capitalize on opportunities that align with their exit strategy.

Lesson 2: A Quality of Earnings (QofE) report can be extremely valuable.

Quality of Earnings (QofE) is a fundamental component of sell-side readiness due to its ability to enhance transparency and mitigate risk. An upfront QofE analysis provides accurate and transparent financial statements, fostering trust with potential buyers and demonstrating the seller's commitment to transparency. By proactively addressing financial discrepancies and irregularities, it reduces the risk of last-minute surprises that could disrupt the sale process.

A clean QofE report can also lead to a higher business valuation, as buyers often pay a premium for businesses with well-documented financials. It attracts serious and qualified buyers, streamlines due diligence, and minimizes the risk of deal breakdowns during negotiations. In essence, QofE ensures a smoother and more successful transition when it comes time to exit.

Lesson 3: Remember to consider your life after the sale.

Thinking about life after the sale extends far beyond the financial aspects of the business transition. It encompasses planning for your personal and professional future once you've parted ways with your business. First and foremost, this involves setting clear personal goals and defining your new role, whether it's retirement, pursuing new ventures, or embarking on a different career path.

Beyond that, it entails taking a close look at your financial well-being and making sure you have a solid plan in place to sustain your lifestyle post-sale. It's essential to consider how the sale proceeds will be managed, whether they'll be invested, diversified, or used for other ventures. Equally important is safeguarding your legacy, which may include philanthropic activities or passing on wealth to the next generation, and ensuring these aspects are well-structured.