Key Takeaways

- Studies have found that approximately 70% of global family businesses do not have a formal succession plan in place.

- Next-generation transitions can be difficult due to lack of communication, fear or intimidation, and unpreparedness.

- Proactive and strategic transition planning allows an organization to define its value, improve operations, identify leadership, and put itself in the best position to move forward successfully.

Family-owned businesses often possess unique qualities that make them a strong candidate for future growth and transition. The business’s brand becomes an extension of the family’s values. The owners keep an eye toward the future with a focus on who could become the next eventual owner. The company’s culture is likely influenced by the desire to create a legacy that lives on for years and years to come.

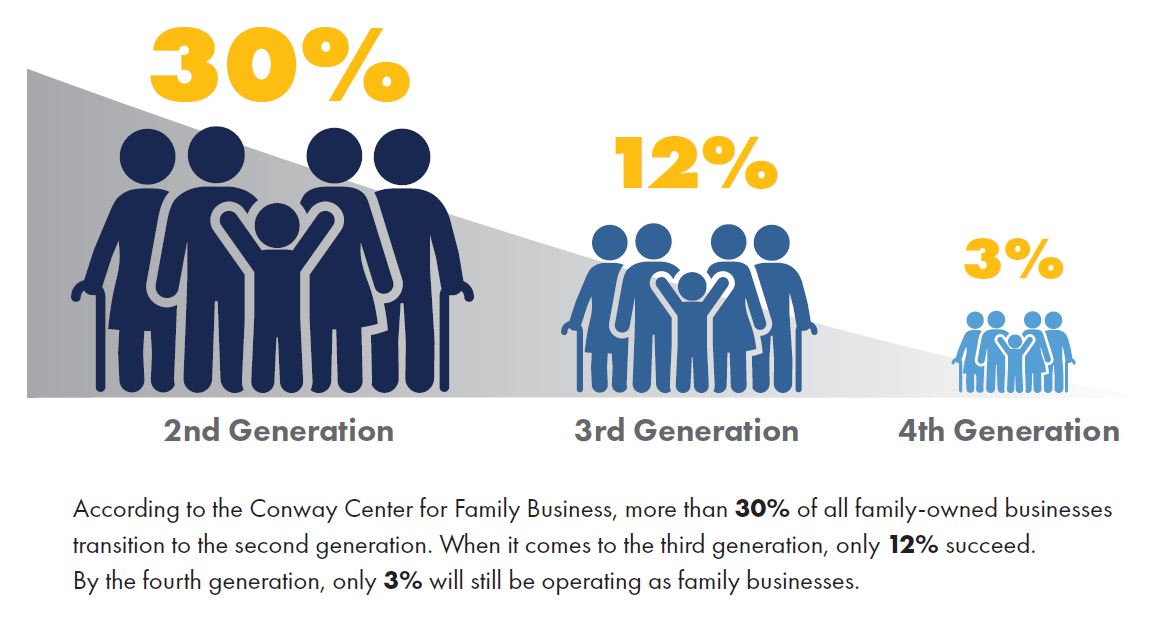

But what happens when transition to the next generation is not an option? According to the Conway Center for Family Business, little more than 30% of all family-owned businesses transition to the second generation, and when it comes to the third generation, only 12% succeed. By the fourth generation, only 3% will still be operating as a next-generation family business.

Are you prepared for the next step of your family business if next-generation succession to your children isn’t on the table?

The Importance of Succession Planning in Family-Owned Businesses

While succession planning is vital, it’s often the biggest hurdle when it comes to family-owned business continuity. Studies have found that approximately 70% of global family businesses do not have a formal succession plan in place. Transitioning your family business to the next generation can be difficult for a variety of reasons, the most common being:

Lack of Communication

Unfortunately, many family members find it difficult to have succession-related discussions, which can lead to misunderstandings, assumptions, and unmet expectations. For example, parents may assume that their children are interested in taking over the business without actually consulting with them. Similarly, children may assume that their parents or grandparents will always be around to run the business, leading to stress and frustration when that turns out not to be the case.

To avoid these issues, it’s important to have conversations early and often about your expectations and goals for transition. This can include asking your children questions about their career aspirations and interest in taking over the business, as well as discussing the challenges and opportunities that come with owning a business. By being open and transparent about your vision for the company, you can ensure that everyone is on the same page and working towards a common goal.Fear, Intimidation, or Disinterest

Family members may feel afraid or worried about taking on the responsibility of running the business. This can be due to a lack of experience, expertise, or confidence, or it can stem from a perception that the business is too risky or difficult to manage. For example, if conversations regarding the business often revolve around complaints, challenges, or emergencies, children may believe that working in the business is difficult, unpleasant, or never-ending. They might not want that future for themselves.

Additionally, family dynamics can create power struggles or favoritism, making it difficult for family members to work together effectively. This can be particularly challenging when it comes to succession planning, as family members may be reluctant to step aside or allow others to take on leadership roles.

Unpreparedness

Even if you think you have a solid transition plan in place, it’s encouraged to have a back-up plan. You may have spent time and energy training one child on the workings of the business, but what happens if that child has a terrible accident, or decides against stepping up to lead the business?

Furthermore, it’s important to distinguish between giving family members specific functional roles in the business and actually allowing them to participate in decision-making and leadership positions. Simply giving family members functional roles without proper training and mentorship may not be sufficient for them to take on leadership roles effectively. They need to learn the crucial skills of management, negotiation, and planning to feel prepared to take over.

To address these challenges, family-owned businesses should work to create a culture of collaboration and support within the family and the business. Establishing clear lines of communication, setting expectations, training interested family members, and creating a succession plan that outlines roles, responsibilities, and timelines for the transition of leadership are all crucial to the long-term success of the business.

As the business owner, ask yourself the following questions:

- How much longer do I plan to work or stay involved in the business?

- How much control do I want after my exit?

- How do I plan to replace myself?

- Are my records in order?

Exiting your business takes time if you want to do it responsibly and profitably. Ideally, your exit strategy will be part of your business plan, keeping in mind that the strategy you create may change over time.

Take Bill and Mary Ann Eckroth, for example, who purchased a music store in Mandan, North Dakota in 1972 with the vision of bringing quality music education to the students, families, and educators of their community. Over the last 50 years, the business has passed to the next generation, expanded to over nine locations, and extended ownership to its employees.

Learn more about Eckroth Music’s generational legacy.

Alternative Options to Next-Generation Family Business Succession

Transition planning for the next-generation family business is critical, regardless of whether it is to family or non-family members. Proactive, strategic transition and succession planning allows an organization to define its value, improve operations, identify leadership, and put itself in the best possible position to move forward and maintain success without issues.

If a next-generation transition is not an option, you can explore alternative options to ensure your business lives on after your exit.

Non-family member options include:

-

ESOPs:

An ESOP is a qualified retirement plan that invests primarily in employer stock, thus making all employees “owners.” -

Strategic Buyers:

Strategic buyers typically buy 100 percent of your business and assume all responsibility for it. Examples include outside parties like competitors or customers. -

Financial buyers:

Financial buyers are organizations such as private equity groups (PEGs), venture capital firms, or hedge funds. Keep in mind that these organizations often require majority ownership, so you will want to ensure you share the same goals and values with financial buyers prior to selling. -

Family Offices:

These entities operate similarly to private equity groups but are unique in that they are established solely to manage a family’s wealth.

To truly align with the goals and objectives you have for exit, as well as gain optimal value for what you’ve built, you’ll need to put careful thought and consideration into each of these options.

Next Steps to Take with Your Family-Owned Business

Regardless of which transition option you choose, prior planning is key. To start, ask yourself:

- How much money do I want to make from the sale of my business?

- Do I know what my business is worth?

- If I had an offer today, could I take it?

Your answers to those questions will help guide you through the following transition planning considerations:

Business Valuation

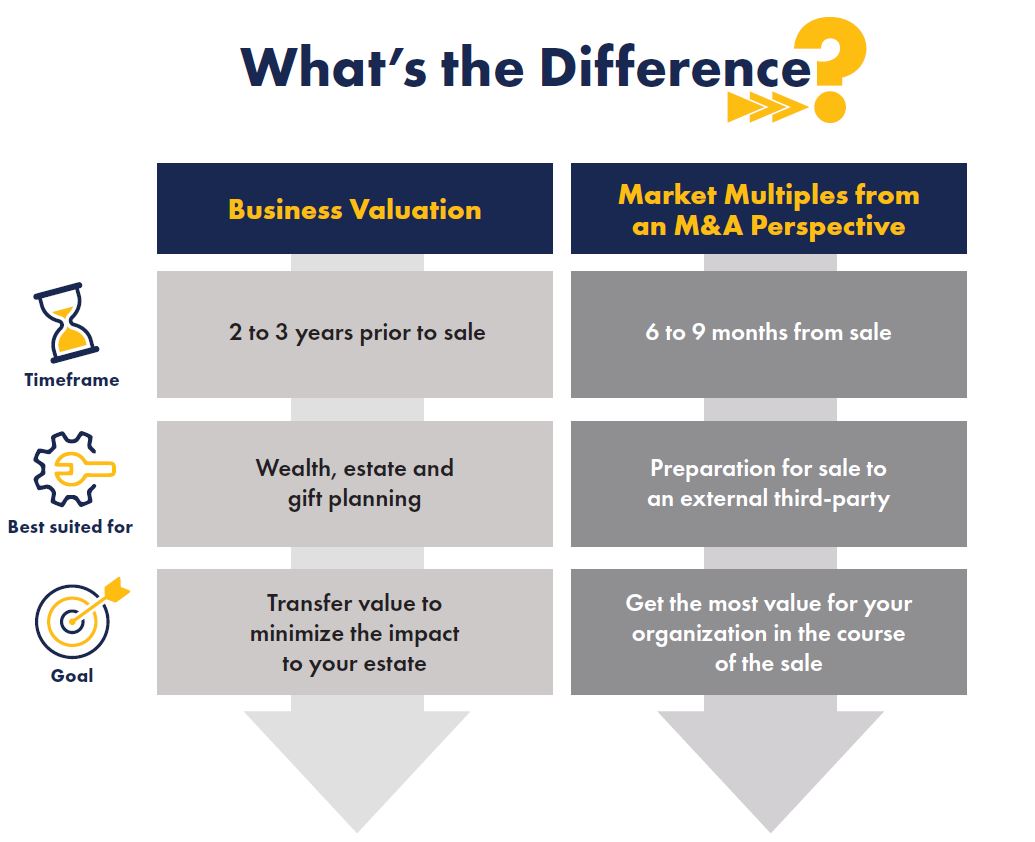

One of the first steps we encourage family-owned businesses to take when preparing for transition is to conduct a business valuation. Having an independent appraisal of your company’s worth can help you with succession and wealth planning. Specifically, business valuations are helpful for companies planning two to three years out for exit to give them time to increase the business’s value, fix any processes or procedures that are not working optimally, and set up gifting and estate options. It’s also helpful in identifying key value drivers, risks, and opportunities.

However, if your goal is to go to the market now, it’s important to speak to a transaction advisor as soon as possible.

Merger and Acquisition Activity

What if you’re ready to sell your business in the next six to nine months? This is where the help of a trusted transaction advisor comes in. These professionals are trained in merger and acquisition activity and can help you understand what your company will go to market for. Specifically, a transaction advisor can help you conduct a quality of earnings report and pull market multiples that will show how your business’s worth across areas like revenue, industry, and EBITDA.

Understanding the value of your business is critical for a family-owned business, regardless of your company’s transition plan. Without it, you’ll have no idea what needs to be improved or how to get the full value for what you’ve built. The important point here is to understand the impact of planning and to contact the right professional to help you reach your goals.

Sell-Side Readiness

If you choose to sell to an external third-party, it’s important to be prepared. Sale opportunities can come at any time. With advanced planning, you can not only understand the worth of your business, but also know how to answer should an option arise.

For family business owners, the preparation for sale might be more emotional than they initially thought. That’s often because family businesses are looking to transfer more than just their financial wealth. They also want to ensure the buyer can maintain the company’s culture. As one client put it, “it’s not like selling a product you sell everyday – it’s way more personal. It’s like selling an entire being.”

Sell-side readiness can help family businesses prepare for the personal and business impact of transition planning. Sell-side readiness involves the creation of a clear vision and goals for any transaction, as well as a roadmap for how to achieve those goals.

Action steps include:

- Positioning your company financially for sale and preparing yourself psychologically for the transaction.

- Understanding the steps in the transaction process and how long each step will take.

- Knowing what needs to happen when it comes to due diligence.

- Preparing your team for new ownership.

- Optimizing the value of your business now.

Selling your business, especially when it is family owned, is not a straightforward process, and there’s no one-size-fits-all solution. Preparing early can help ensure you have the optimum selling experience.

Planning for the Now – and the Next

Family-owned businesses are critical to the economy. In fact, research has shown that family-owned businesses account for 70% of the global GDP. Yet for all their strengths, family businesses continue to lack a clear path to exit. Without a solid succession plan, even the best family businesses may lose what they’ve created. And with the added stress of lack of next-generation family business buy-in, it’s time for these entities to look at other means for exit.

Careful, proactive planning can ensure that your family business carries on for years to come, even if it’s not family owned.

Owner Readiness: Challenges and Opportunities When Preparing for Exit

Read the Article

Read the ArticleOwnership Transition

A trusted advisor can help you understand the decisions and actions you can take throughout your transition journey.

Who We Are

Eide Bailly is a CPA firm bringing practical expertise in tax, audit, and advisory to help you perform, protect, and prosper with confidence.