Not too long ago, the CFO’s role mainly revolved around preparing the company’s financial statements. But today’s CFO is facing many different responsibilities, expectations and challenges. Today, the role of a CFO is that of a key business advisor. CEOs rely on their Chief Financial Officers for both financial analysis and general business analysis to guide direction and decision making as a whole.

The Changing Role of the CFO

A study from McKinsey indicates that the number of finance leaders responsible for their organizations’ digital activities has more than tripled over the last five years. The same study shows that the finance team’s adoption of digital is more common at the best-performing organizations and that technology adoption in finance is a leading indicator of an organization’s overall resilience.

In order for organizations to become disruptive leaders in a changing marketplace, their CFOs need to gain a big-picture, holistic view of the business—one that goes beyond simple financial statements and delayed month-end reports. As a CFO, you need to keep tabs on the entire business in real-time. And that’s where a data warehouse becomes a key player in the success of a top-performing Chief Financial Officer.

What is a Data Warehouse?

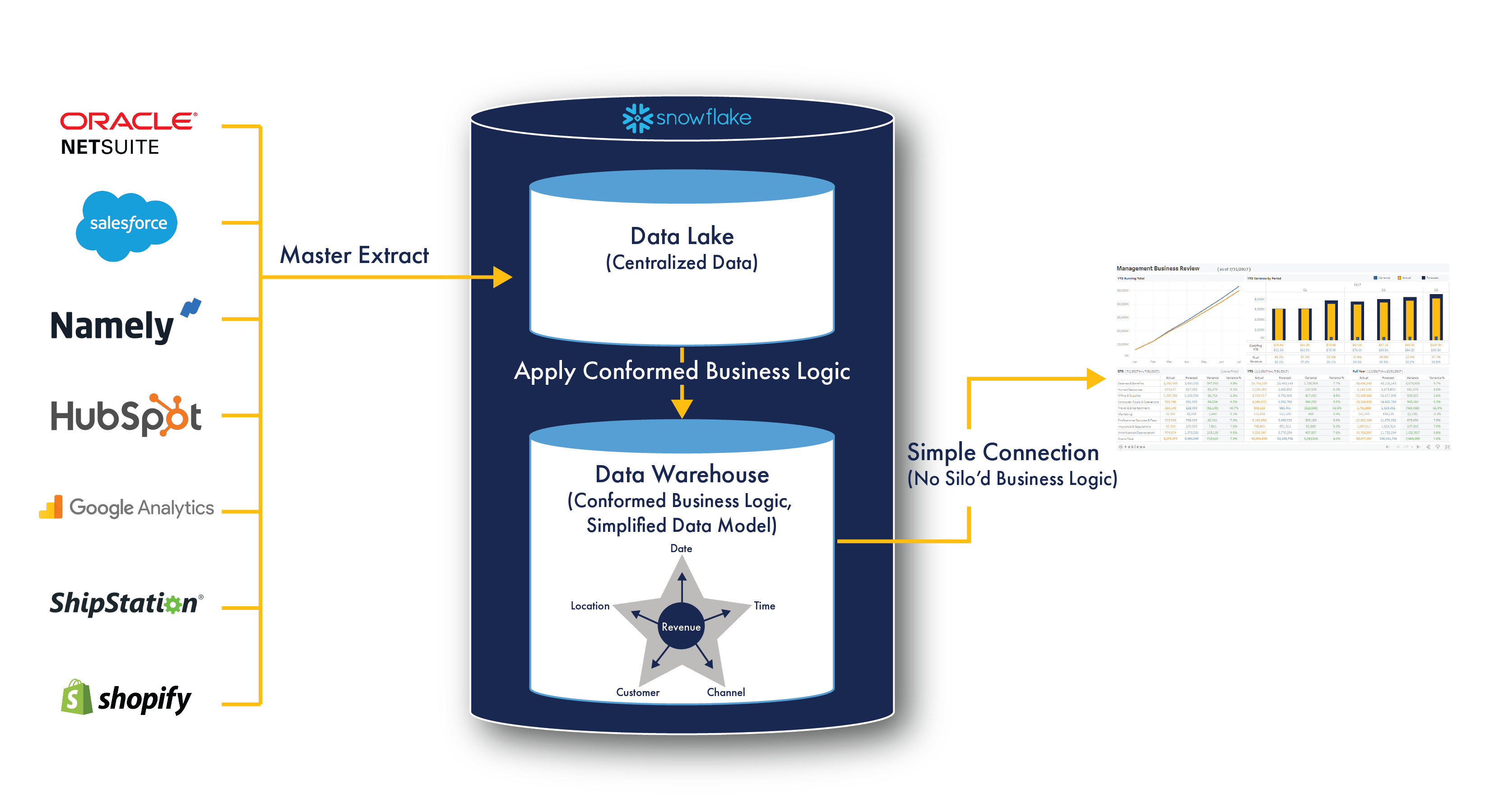

Simply put, a data warehouse is a central place where your data is stored. That data is collected and combined from many different sources and can include both current and historical data. The main advantage is that by housing all of your organization’s data in one place, you gain full control over how your data is stored and queried in the future.

For CFOs, a data warehouse supports both your operational and financial analytics by centralizing and combining all of your key business data.

When built right, a data warehouse allows you and your team to be self-sustaining and effective. It enables you to conduct the deep analyses and create the reports you need to be successful. Your IT department has the capability to run and analyze complex reports, so a strong partnership between finance and IT can result in powerful results for your organization. Gone are the days when you can wait several days for critical reports and updated numbers. Time is money, and your data is knowledge.

By having direct control of analytical and reporting tools with a cloud-based data warehouse, the CFO can have the speed and agility needed to respond to the demands and needs of the business.

How Does a Data Warehouse work?

Why Excel Isn’t All You Need

Often, CFOs do the majority of their financial planning in Excel. It’s got macros, workbooks, links and it’s a tool most finance leaders are comfortable with. And while Excel does have its place and works well for certain use cases, the problems arise when you start using Excel to do things it wasn’t made to do.

- Excel vs. a Data Warehouse

We worked with an organization that had one person running their business’s entire FP&A process using only Excel. The spreadsheets were massive. It would take 20 minutes to open just a single file, which would often become corrupted after a short time. The analyst would then have to start over from scratch.

During budget season, the company’s executives would throw a what-if scenario out to the analyst. Questions like, “What if next year we grew accounts by 35%?” would require hours or sometimes days for the analyst to push the hypothetical scenarios through the formula to arrive at an answer.

Not only is this counter-productive to the leadership team’s time, but it was a terrible and time-consuming process for the analyst.

When we were brought in to help fix the problem, we started by pushing all the logic from the Excel spreadsheets into a database. We built the data warehouse to manage all the data prep heavy lifting and kept Excel as the reporting tool. With this new setup, the executives have access to real-time, instantaneous answers to all their what-if scenarios.

The Need for a Source of Truth

You don’t have to get rid of Excel, but you can’t use it as your core data solution. Your business will start to run into issues when you use Excel for something it wasn’t built for—like being a database. It was never meant to be a stand-alone, end-all-be-all BI solution.

But the fact remains that many CFOs are still relying on Excel spreadsheets to be their core database when that logic should live in a data warehouse and be pushed to Excel for visualization and analysis.

❯❯❯See how this company has transformed the way they do business with a data warehouse.

See the Black Clover Case StudyHow a Data Warehouse Helps CFOs Become More Efficient and Productive

Not only does a data warehouse let you answer questions faster, but getting results also requires significantly less time and resources.

As shown in the scenario above, the Excel reports were slow and unwieldy. Preparing them was an arduous, manual process. That’s because creating these reports in spreadsheets requires hours and hours of daunting and time-consuming manual data prep. It’s tedious, inefficient and destroys team morale. And it’s also highly error-prone.

Your business logic ends up being scattered across multiple spreadsheets, which erodes your organization’s source of truth. Every time a change is needed or there’s an error in the data, your spreadsheet gets wilder and wilder. Eventually, this out-of-date logic leads to conflicting or broken reports.

This setup is unsustainable as a long-term strategy. You’ll find yourself in a tangle of disparate and disconnected business logic that will become too much to manage.

With a data warehouse, your business logic is defined in a single location for a single, reliable source of truth. If the logic changes or there’s an error, you only have to update the code once in one place. Best of all, centralizing your data prep in a data warehouse means it can finally be automated. Ninety percent of the manual data prep that’s been weighing your team down can be eliminated. You’ll be able to dive into reporting, analyzing results and uncovering insights.

How a Data Warehouse Helps CFOs Expand Potential

Centralizing your business logic in a data warehouse allows for improved scalability as well. Using only Excel, you can only go as fast as a single person can build a spreadsheet. This may work in the early phases of your business, but at some point, your growth will exceed this timeline.

CFOs are being tasked with providing real-time, up-to-the-minute data and analysis to support the business objectives and executive team’s needs. A data warehouse helps solve this by enabling you to keep a single database and build as many reports as you need in your visualization tool of choice.

You’re also empowered to provide more complete, holistic answers to a much wider range of critical business questions. By combining your financial data with your other data sources, your insights are expanded.

A data warehouse enables you to:

- Create hyper-customizable, ad hoc reports using multiple data sources.

- Predict future growth, identify bottlenecks and reveal pain points.

- Leverage statistical algorithms similar to those used in machine learning, AI and data science.

- Consolidate data from multiple, diverse data sources.

- Query key performance indicators in real-time alongside operational analytics to evaluate team performance.

When to Implement a Data Warehouse

With a data warehouse, the CFO can truly fill the role today’s businesses need. You can provide answers that are fast and accurate. You and your team become an indispensable source of valuable and actionable insight.

If you’re a CFO who wants to be instrumental in achieving greater growth and profitability, a data warehouse is the tool for you. Whether you have no internal data analytics team or a robust data team, the goal of our data analytics team is to meet you where you are and support your data initiatives. We can do that by providing you with a dedicated data team through staff augmentation, upskilling your current team or by providing support when you need it.

Interested in knowing more?

LET'S TALK

We're Here to Help